In B2B manufacturing, it can be easy to fall into the trap of pursuing every lead that comes your way. After all, more leads mean more potential sales, right?

In your pursuit of quantity, you might miss out on something far more valuable—quality. The harsh reality is that not all sales opportunities are worth pursuing.

While casting a wide net might seem like a logical approach to getting new customers it often leads to business that you don’t actually want, resulting in wasted time, resources, and missed opportunities.

Instead, the secret sauce lies in refining your focus and concentrating your efforts where they matter most – on your ideal customers. That’s why you need to create an Ideal Customer Profile (ICP).

An Ideal Customer Profile focuses your sales & marketing efforts

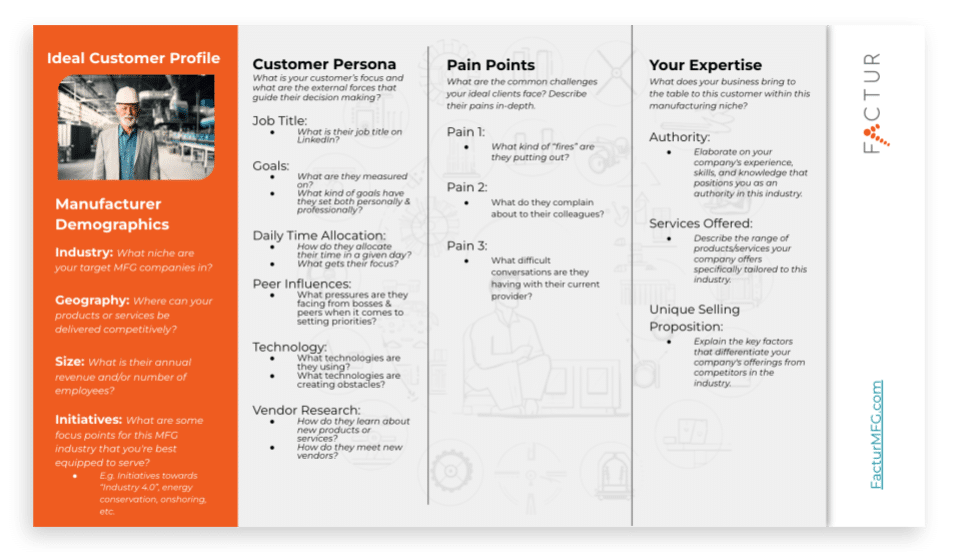

An Ideal Customer Profile (ICP) is a detailed and specific description of your perfect prospect that aligns with your services and goals.

An ICP outlines key characteristics, such as the industries your ideal manufacturers operate in, the size of the companies, and their geographical locations. It encompasses the roles and responsibilities of decision-makers within the manufacturer’s organization, their pain points, challenges, and goals.

Having a well-defined ICP equips your sales team with a deep understanding of your ideal customer. It’s a powerful tool for sales enablement by providing a clear roadmap for targeting the right prospects.

With this type of strategy in hand, your sales team can tailor their conversations, presentations, and solutions to resonate directly with the prospects they engage.

Not sure where to start with an ICP? Here’s a template:

We’ve created a resource for you to use as a starting point. Click here and follow along:

[elementor-template id=”7331″]

To create an effective Ideal Customer Profile for manufacturing, you need to narrow down the specific relevant traits of your target accounts.

Let’s get into the specific elements that make up an Ideal Customer Profile.

First, nail down the manufacturer demographics you’re going after.

It’s very likely that the challenges faced in one industry will be different from the next.

So, it’s important to do this kind of exercise for every industry that you’re operating within.

Industry: Get specific, or your strategy will be like everyone else’s.

Typically, the more niche you can go here, the better.

For example, let’s say you’re targeting contract defense manufacturers. You may be tempted to say I work for “defense”. But then you’ll be like everyone else.

Let’s say you make parts for “Ground vehicle defense manufacturers.” Now you have a clearer starting point and can more clearly articulate what their problems are.

Company Size: Be realistic about who will bite at your offer.

Consider both your company size and the size of companies that will work with you. Typically the most data available from a database standpoint is the number of people and the total revenue.

If the number of facilities or facility sizes are of importance to your business model, that may be another way to define your customers. Note: This data can be more difficult and expensive to source when you are looking to build company lists.

Geography: Focus on territory that you can be competitive in.

If you sell contract manufactured parts, you may not be able to compete with folks across the country if logistics costs are prohibitive.

Be realistic about how far your products or services travel.

Outline where you’re competitive on a map; pinpoint the regions where your customers are most likely to reside and stick to it.

Note: Larger corporations will have locations across the country. So if you’re targeting the likes of Lockheed Martin, for example, maybe you’d be competitive with them locally, but not in other parts of the country.

Initiatives: Understand what industry trends are important so you can speak your customer’s language.

If you understand some of the trends happening within your target accounts, it can give you more credibility as you market to these customers or perform outreach.

Some example buzzwords we often hear are: Green Initiatives, Vertically Integrating Suppliers, Industry 4.0, and the like. Having the pulse on your industry can come from Industry Journals, but even better- the knowledge that you have from customer conversations.

Customer conversations are the best pulse you can have on current issues they’re experiencing.

Speak with your customers often to know what kind of initiatives they’re taking on- this will also help you stay innovative with your existing services.

You’ve set the landscape – now let’s look at the Customer Persona.

So, you’ve got your target Manufacturing demographics nailed down. Now, let’s think about the buyer persona that your marketing & sales efforts will be focused on within these MFG orgs.

Job Title: Document what a majority of your ICPs are calling themselves on LinkedIn.

Get clear here – it’s probably not just an “engineer” for example, but a specific type of engineer; e.g. a “Design Engineer”.

Is there a buying committee that plays an equally important role in making the decision?

If you’re selling CAPEX, that’s almost certainly the case.

That may mean creating multiple ICPs, or at minimum, noting that there is a buying committee involved outside your key decision-maker.

Look at a sample of 10 companies on LinkedIn; compare job titles of your ICP across those accounts, and write the most common title you find.

Goal: Stand in your ICP’s shoes and consider what’s driving them.

Understand what makes your ICP tick.

Some examples of goals they may be driving for:

- Cost reduction (Purchasing Managers)

- Decreased manufacturing time (Design Engineers)

- Energy reduction (Corporate C-suite Finance Execs)

- Process optimization (Production Line Manager)

Talk to an existing customer that fits your ICP and ask them what KPIs they’re driving towards if you’re not sure.

Time Allocation: Bucket your ICP’s time into 3-4 categories.

Consider putting your ICP’s time allocation into buckets, 3 buckets at a minimum.

As an example (hypothetical), maybe an Engineering Director in the pump manufacturing industry is spending their time as follows:

10% – Creating Engineering Designs for high-priority projects

30% – Training Design Engineers

60% – Putting out fires on the production line

Peer Influences: Your ICP’s boss & colleagues play a role in the pressures they face.

Behind the scenes of any customer, they’re going to face multiple interactions and pressures from other positions.

Those positions may have power over your ideal customer – or may not – but they will likely have something to do with the decisions that are made by your ideal customer.

Map them out, and note anything that may be worthy of consideration as you market & advertise to your ICP.

That could mean also marketing to folks who are not your ICP so that you build trust with other stakeholders that would influence decisions.

Technology: Get a better picture of where time is spent and how they’re interacting with their environment.

If your prospects have buying power, they’re working on a computer or possibly overseeing machinery. You’ll want to list out:

- What kind of software they are using in their role

- What type of machinery or equipment they are interacting with or overseeing the use of

- How they are interacting with others through tech

- How tech is saving them time (or the opposite – creating inefficiencies!)

Vendor Research: Map out where they’re learning about new products or services.

This question is a selfish one as you consider B2B Sales, but will be key to your strategy as you consider how you’ll get in front of your target customers

Here are some examples of where they may get their information:

- LinkedIn (influencers, groups)

- Tradeshows

- Industry Magazines / websites

- Their peers / network

- Sales conversations (i.e. relying on sales folks to find and educate them)

Pain Points: The thing that can really set you apart from the competition.

Understanding your customers’ pains goes beyond “they need quality parts” or “they need on-time deliveries”.

Most B2B organizations selling to manufacturing struggle here because they want to talk about themselves.

What your customers actually want to hear about is THEIR problems (counterintuitive, we know)- and then they only want to hear about you after you’ve demonstrated you understand their problems.

Here are some ideas to get you thinking about your ICP’s pain points:

- What lives in their head as they drive home & sit down for dinner with their families?

- What kind of “fires” are they putting out?

- What do they complain about to their colleagues?

- What difficult conversations are they having with their current provider?

Don’t know? Again, you’ll have to need to ask them.

Bringing it Together: Speaking to Your Manufacturing Customers’ Pains with Your Expertise

Self-promotion can feel slimy to some. Looking at you, Engineers.

But, there’s a place for it.

You’ve documented the Manufacturing facility, the customer persona, and their challenges.

Bring it all together by outlining how you can specifically guide your ICP to overcome these challenges in their manufacturing environment.

Authority: Show off your customer base and authority in the manufacturing niche.

Your knowledge of the industry’s ins and outs can go a long way in demonstrating authority.

Here are some questions to get you thinking about how to demonstrate authority in your niche:

- What customers are you serving in this niche that show you’ve been there before?

- What examples do you have (case studies) where you’ve provided successful outcomes?

- What metrics can you demonstrate that connect to your customer’s KPIs?

Unique Selling Proposition: Plant your flag in the ground and let your customers know how you’re different.

Questions to consider:

- What are you doing in your process that other manufacturing suppliers can’t fulfill?

- As a product maker, what’s different about your products that no one else can say?

Avoid “quality, service, delivery” statements like the plague and you’ll be leaps and bounds ahead of your competition.

Services Offered: What you can specifically provide to this ICP specifically within this niche.

If this answer looks the same as any other industry you sell to, you may want to think again.

In other words, can you think about an offer that would be unique to each industry?

Again, every niche will encounter different problems, and you’ll want to tailor your services differently depending on what niche you are serving.

Grab your ICP Template

Ready to dive into the specifics? We’ve got you covered with our customizable Ideal Customer Profile template for manufacturing suppliers.

[elementor-template id=”7331″]

With this template, you’ll have a clearer understanding of your ideal customer, their needs, and how you can cater to them. Remember, precision targeting is the name of the game, and your ICP in hand will help.